prince william county real estate tax payments

The County works directly with ACI Payment Inc. Teléfono 1-800-487-4567 entrando código 1036.

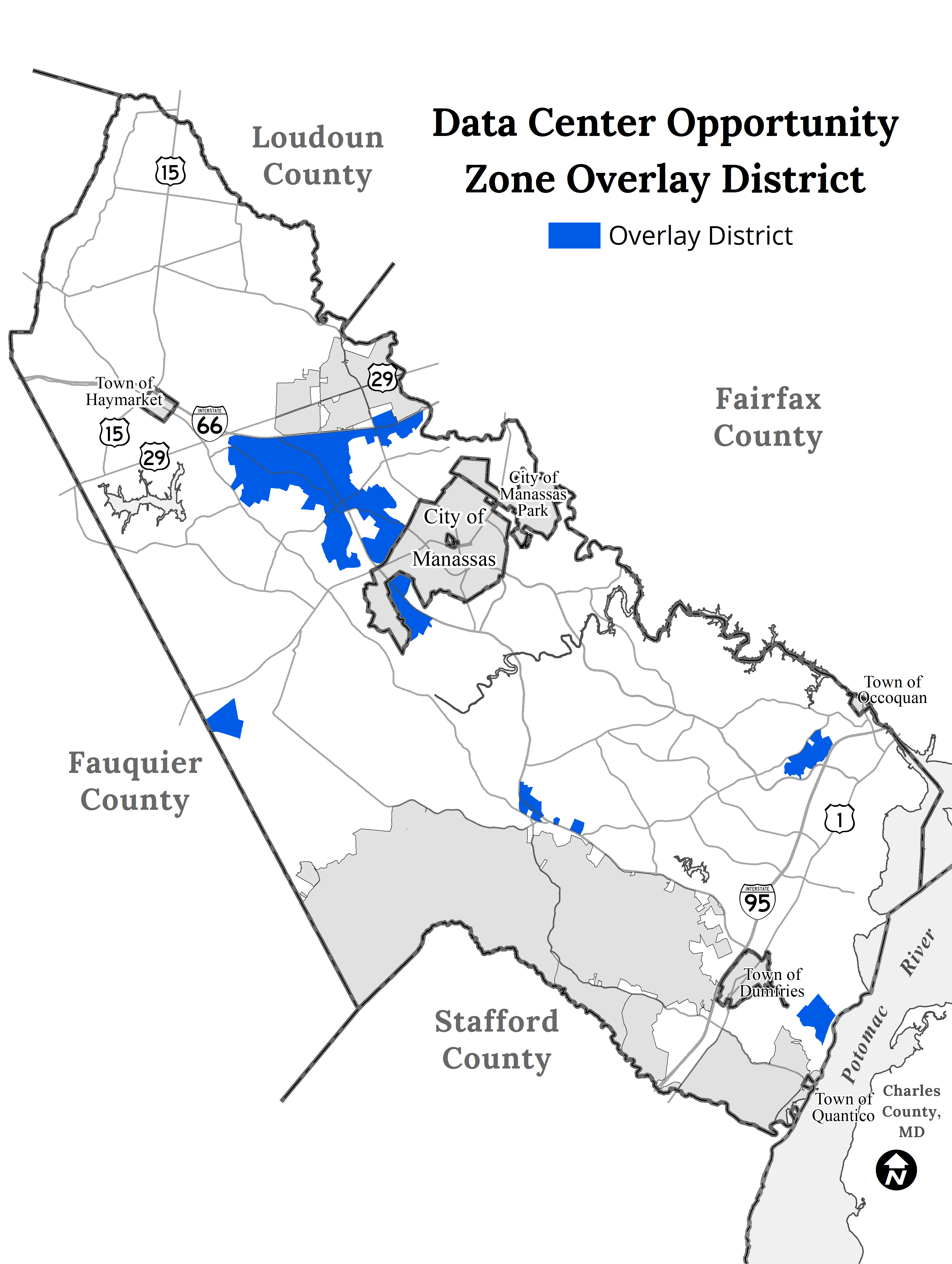

Data Center Opportunity Zone Overlay District Comprehensive Review

Included on the real estate tax bills is the special district tax for the gypsy moth abatement program.

. Prince William County Property Tax Payments Annual Prince William County Virginia. Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date. All you need is your tax account number and your checkbook or credit card.

If you have questions about this site please email the Real Estate Assessments Office. 1-888-272-9829 enter code 1036. By creating an account you will have access to balance and account information notifications etc.

Prince William Virginia 22192. Click here to register for an account or here to login if you already have an account. Get driving directions to this office.

Use both House Number and House Number High fields when searching for range of house numbers. In Prince William County Virginia the tax rate is 105 which is. 2021 Property Tax Town Hall Property Tax Town Hall 2021.

2 days agoLocal taxes could go up again in Prince William County in the coming year under a proposed 148 billion budget proposed by acting-County Executive Elijah. Provided by Prince William County. There are several convenient ways to pay your bill.

300000 100 x 12075 362250 The real estate tax is paid in two annual installments as shown on the tax calendar. 703 792 6780 Phone The Prince William County Tax Assessors Office is located in Prince William Virginia. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

There are several convenient ways property owners may make payments. For more information please visit Prince William Countys Department of Real Estate Assessments or look up this propertys current valuation. Prince William County Virginia Home.

You can pay a bill without logging in using this screen. Enter the house or property number. Prince William County real estate taxes for robust first noun of 2020 are.

Median Property Taxes No Mortgage 3767. Prince William County Virginia Property Tax Go To Different County 340200 Avg. 4379 Ridgewood Center Drive Suite 203.

Enter street name without street direction NSEW or suffix StDrAvetc. To provide convenient online and telephone payment options. By phone at 1-888-272-9829 jurisdiction code 1036.

Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. Median Property Taxes Mortgage 3893. Free Prince William County Property Tax Records Search.

A convenience fee is added to payments by credit or. What is different for each county and state is the property tax rate. The Williamson Central Appraisal District is a separate local agency and is not part of Williamson County Government or the Williamson County Tax Assessors Office.

Provided by Prince William County. If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. The Williamson Central Appraisal District is located at 625 FM 1460 Georgetown TX 78626 and the contact number is 512-930-3787.

A collection fee of 30 is added to accounts for more than 30 days delinquent. The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct. 09 of home value Yearly median tax in Prince William County The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Prince William Board of Supervisors extends real estate tax payment due date to October 15 Arabella Thornhill July 15 2020 at 554pm Citizens and businesses struggling to pay real estate taxes. The real estate tax is paid in two annual installments as shown on the tax calendar. Prince William property owners will get a three-month extension on their real estate tax bills as a result of action the board of county supervisors took Tuesday.

-- Select Tax Type -- Bank Franchise Business License Business. Prince William County Real Estate Assessor. The board voted unanimously to defer payments for the first half of annual real estate taxes originally due today July 15 -- until Oct.

Find Prince William County residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. Then they get the assessed value by multiplying the percent of total value assesed currently 100. Then they multiply that by the tax rate to get your property tax.

How The Payment Process Works. You can read more at Propety Taxes in Prince William County Virginia. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs.

By mail to PO BOX 1600 Merrifield VA 22116. The fire levy rate is also reduced from the current rate of 008 per 100 of assessed value to 0075. Payment by e-check is a free service.

Mo johnson Hi the county assesses a land value and an improvements value to get a total value. This tax is based on property value and is billed on the first-half and second-half tax bills. The County also works with PayPal for online payments.

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Prince William County Housing First Time Homebuyer Program Youtube

The Rural Area In Prince William County

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

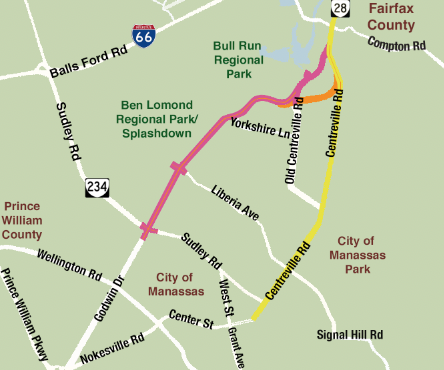

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

5572 Saint Charles Dr Woodbridge Va 22192 Saint Charles Dale City Keller Williams Realty

Join Renew Realtor Association Of Prince William

National Park Service Prince William Forest Park Sign Virginia Travel National Park Service Forest Park

Prince William County Looking To Attract More Offices Mixed Use Projects Prince William Insidenova Com

Prince William Wants To Hike Property Taxes Introduces Meals Tax